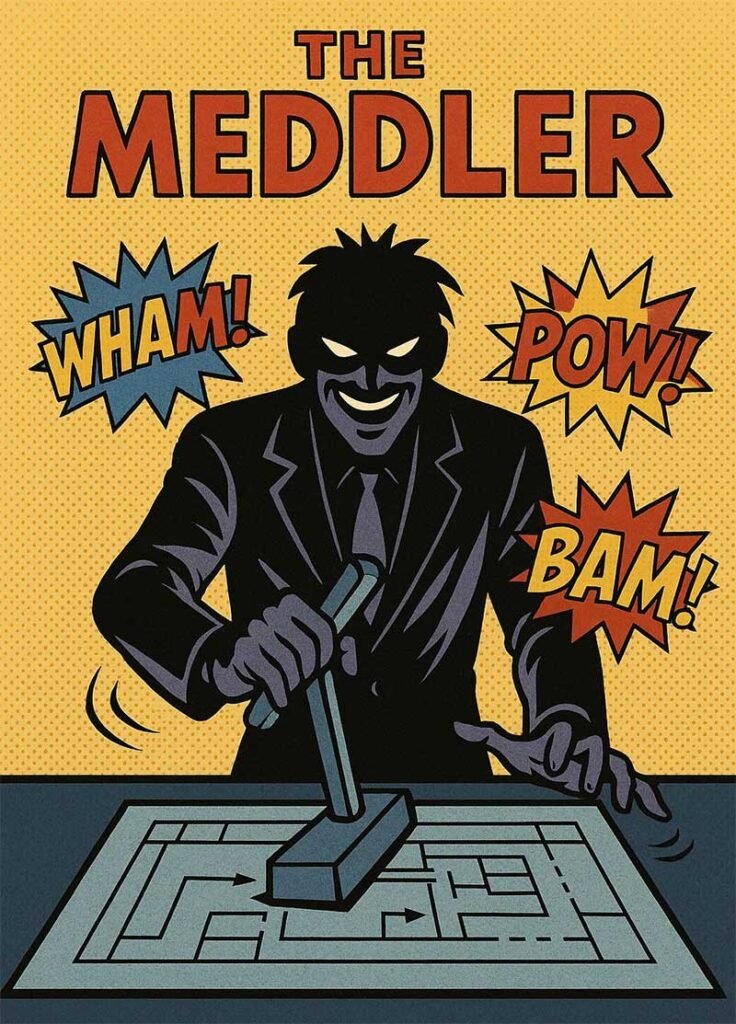

If Gotham ever needed a new villain, “The Meddler” could be a perfect addition.

He wouldn’t rob banks or blow up bridges.

He’d just… tweak things

Modify plans before they ever got a chance to get going.

Demand we chase the next shiny idea from a LinkedIn Post.

All with a maniacally laugh and a signature catch phrase:

“Just trying to help.”

He’d leave behind a wake of chaos.

We had a great plan, but the tweaks, modifications and new methods left us confused and off course.

The Meddler is Everywhere

The truth is, The Meddler isn’t confined to Gotham’s city limits.

He’s right here with us. And many times, we are him.

It usually starts with good intentions:

- “I want to speed this up.” (We pivot too soon, before the plan has had a chance to work.)

- “I want to show I’m involved.” (We step in when it’s not needed.)

- “This new idea is exactly what we need.” (We chase every novelty, even if it’s not right for us.)

- “I just follow the data.” (But we react to every bump as if it’s a meaningful trend.)

Said another way:

We’re impatient.

We’re insecure.

We are uncertain.

We misread noise as a signal.

In each case, the impulse is the same: default to action.

WHAM! POW! BAM! Just like in Batman.

And action is good.

But only if we’re moving in the right direction.

What we need is something we can use to better guide us.

Great Investors Follow a Thesis

Great investors avoid The Meddler because they ruthlessly follow a thesis.

- Warren Buffet has a solid rule to invest in companies with pricing power, a good moat to protect against competition. The stock price will rise and fall, but he only acts if the key element of his thesis (the company’s pricing power) wains.

- George Soros / Stanley Druckenmiller similarly are well known to cut fast when facts change.

- Peter Lynch has been quoted as saying “if the story hasn’t changed, don’t”.

With each of these successful investors, they all had an underlying thesis. If they didn’t, they wouldn’t know when to act.

Now imagine The Meddler as your investment advisor. He chases stocks after they spike, dumps them just before they recover, explaining it all with vague “market blather.” That’s scarier than any Batman villain.

Yet, in many businesses, we act like The Meddler and give a thesis little attention. We don’t write it down fully. We don’t challenge it. And we rarely measure it properly.

Introducing: Thesis Driven Operations

Just like great investors operate with a thesis, great operators run their business the same way.

I call this Thesis Driven Operations.

It’s the kryptonite for The Meddler (my apologies to comic book fans for mixing heroes).

Running a successful business requires a commitment to a clear, evidence-based set of assumptions about how and why we win AND using that thesis as a filter for every decision, from strategy to daily execution.

Without a thesis, we’re vulnerable to every short-term fluctuation.

With a thesis, we can tell the difference between noise and a genuine signal to act.

Thesis in Action

If we want to successfully fight The Meddler, we need to build a good thesis.

A good thesis will contain more than a vision or goal.

The thesis will contain the key elements and assumptions that need to continue to be true for us to win.

These key elements are the ones to pay particular attention.

For example, we perform an analysis on our target market. The analysis was built from data, market surveys and interviews with both customers, prospects and employees. From this, we conclude:

“We will win by focusing exclusively on mid-market companies in regulated industries. Additionally, our approach will be to grow by landing small and expanding over time.”

This thesis drives our plan.

But the fight isn’t over.

If we measure the same metrics “we always did”.

We see results we don’t like.

We abandon the plan.

We return to normal.

The Meddler wins.

To Win – Embrace the Thesis

To win, we need to have a good thesis AND we need to embrace it.

If we are targeting mid market companies in regulated industries, are we measuring how many we are talking to?

Is our marketing bringing in more of these types of customers?

Is our close rate improving for these customers?

Are we landing small accounts in this cohort?

Are these small accounts expanding consistently over time?

When we have a good thesis, we can then measure ourselves against it.

AND, we can then have a better idea when actions that we are prone to take are meddling or acting to stay ahead.

Key Takeaway (TL; DR)

Last week, I wrote about “How the Best Stay Ahead“. This post is in response to a comment I received asking “how to tell the difference between ‘meddling’ and staying ahead of the curve.”

For me, the difference is why you act.

If you act out of impatience, insecurity, uncertainty, or boredom — it’s probably meddling.

If you act because your thesis has changed — you’re staying ahead.

Action is necessary.

The key is knowing what’s noise and what’s signal.

And that starts with a good, well-articulated thesis.

The Meddler thrives in chaos. Your thesis is your Bat-Signal. Keep it lit.